Complete Guide to Fintech App Development

Summary: If you are an aspiring entrepreneur wanting to start your business in the fintech industry, this blog is for you. Discover the various types of financial apps and steps to build a successful fintech app.

Whether making a small payment at the grocery store or making major investment decisions, the fintech app industry has revolutionized the way people handle their finances.

The major reason for its success is its ease of use and the ability to manage several financial actions through one digital platform. Fintech apps have also enhanced the safety and security of people’s finances.

Seeing its popularity and the actual need in the global market, many entrepreneurs are jumping into this industry. If you, too, are planning to create a financial app, this blog will help you understand the step-by-step process.

Discover the types of fintech apps you can invest in and how to develop custom financial software.

Table of Contents

Steps to Build a Fintech App

Many startups who wish to get into the online fintech industry often have a question, “How to build a fintech app that attracts the audience?” Below are the complete steps to develop the app.

1. Understand the Fintech App Market

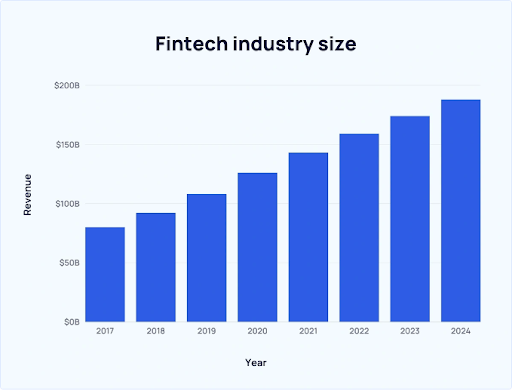

Before you begin with fintech app development, it is crucial to get in-depth knowledge of this industry. The market for fintech apps is expected to reach $917.17 billion by 2032, which means that startups have a great chance of building their personal finance apps.

Reports have also shown that the number of fintech startups has grown to over 26,000 worldwide. This is mainly because of the demand in the global market for apps that make banking, payments, financial planning, and budgeting easier. Many of these apps utilize financial charts and graphs to provide users with clear visual insights into their financial data.

2. Identify the Niche

Once you know about the market, it is time to identify the right niche for your fintech startup. There are several types of fintech apps that you can create for your business. These include:

- Digital banking apps: Digital banking apps provide a full range of banking services and enable users to manage their accounts, make transfers, pay bills, and access financial insights. They are designed to provide a seamless and user-friendly alternative to traditional brick-and-mortar banking.

- Payments and money transfer apps: Another popular type of fintech app is the payment and money transfer app. These focus on enabling users to facilitate transactions, from making online purchases to transferring money to friends. They use digital wallets and payment gateways to streamline smooth transactions.

- Personal finance management apps: This type of fintech app focuses on helping individuals track their income, expenses, and savings to manage their finances better. Personal finance management apps include various features for budgeting, categorizing transactions, setting financial goals, and providing insights to enhance money management strategies.

- Investment and trading apps: Investment and trading apps are designed to provide opportunities for users to invest in several financial instruments like stocks, ETFs, and mutual funds. These apps provide easy access to market data, real-time trading, and investment analysis, helping users grow their wealth and participate in the financial markets efficiently.

- Insurance apps: InsurTech applications are other widely used fintech apps. These provide users with great convenience to access various insurance policies, claims management, policy comparisons, and personalized insurance solutions. Using the latest technology, InsurTech apps simplify the insurance experience and protect users from any risks.So, before you begin the fintech app development process, you must choose the right app for your business.

3. Choose the Features and Functionalities

Now that you know what fintech app you want to develop for your business, the third step is to choose the right features and functionalities that solve the pain points of your target audience. Selecting the right features is crucial to ensure the data security of your app users. Some must-have features for your financial software development include:

- User authentication and security

- User profile creation and management

- Payment and money transfer

- Personal finance management

- In-app chat support

- Integration with third-party services

- Data analysis and insights

In the beginning, you can always pick only the necessary app features to engage the audience. Further, with time, the fintech app developers can add more advanced features that enable powerful finance solutions.

4. Design the App to Attract Users

Just choosing the right features is not sufficient. Designing is an equally important aspect of the financial services app development process. The app must be easy to use with clear UI/UX. As per the research, 90% of users stopped using an app due to its poor performance. In order to avoid this situation, you must design your fintech app the right way.

Some UI/UX design tips for financial app development include:

- Design a user-friendly interface with easy-to-understand navigation for seamless access to key features.

- Use a clear visual hierarchy to prioritize necessary information and guide users to essential actions.

- Maintain consistent branding elements and design language throughout the app for a cohesive user experience.

- Choose readable fonts and text sizes to ensure accessibility and readability for all users.

- Accessing the information related to users’ financial details should be quick and easy.

Hence, work on the design that makes the fintech app engaging and easy to use.

5. Choose the Right Fintech App Development Team

The development process requires experienced and skilled fintech app developers who work with the right tech stack. For instance, at ValueAppz, we use technologies like React, Node, and Next.js to ensure quality. Further, our pre-integration services will save you tons of time and money.

The development team will help in creating a custom fintech app that aligns with your business goals.

6. Test and Iterate

Before the final launch of your personal finance app, it must go through proper testing. This stage will help identify the pitfalls that can otherwise create a problem for the users. Based on the testing, the developers will fix the bugs and errors to ensure a smooth user experience. Also, gaining early user feedback will help you understand what your target audience needs exactly through this fintech app.

7. Launch the Final App

Now that the app is free of errors, you can launch the fintech app on respective platforms. Even after the app has been launched and reached the users, regular improvements will always be needed. Based on the feedback, you can add features, functionalities, and other aspects to the app. Remember, making the fintech app a success is a continuous process that involves identifying the right user needs and iterating the app, respectively.

Your Most Trusted Fintech App Development Company

As mentioned above, to make your fintech app a success, you need a team of experts who have relevant experience and skills in this industry.

Our dedicated teams at ValueAppz are trained to use the latest technologies to build robust FinTech apps. No matter what your business requirements are, we are here to help. Contact our consultants to get a quote for your FinTech app development.

Get in touch with us, and let’s discuss your taxi booking app idea.

Key Takeaways

- Fintech apps have completely changed financial management and provide users with efficiency, security, and convenience.

- When investing in fintech app development, it is crucial to understand the market and choose the right type of financial app.

- Adding custom features and functionalities that solve the pain points of the users can help make your fintech app a success.

- A well-designed fintech app will help attract users and engage them with the features and functionalities.

Frequently Asked Questions

Q1. What are the latest trends in fintech app development that I should consider?

Some of the latest trends in fintech apps include AI-driven personalization, integration with blockchain technology, and transparency in transactions.

Q2. What is the user flow of a fintech app?

The user flow of a fintech app includes making a clear hierarchy of information and actions to enable users to quickly find the features and functionalities.

Q3. What are the long-term considerations for scaling and maintaining a successful fintech app?

Long-term considerations for scaling the fintech app involve continuous technological updates and scalability to accommodate a growing user base.

Q4. How do you optimize the cost of finance app development?

Optimizing the cost of finance app development involves leveraging open-source technologies, reusable components, and agile methodologies to streamline development processes.

Q5. How long does it take to build a financial app?

The fintech app development process can take between 10-12 weeks to complete.

THE AUTHOR

Priya

With 5 years of marketing experience under my belt, I bring a data-driven approach to my writing, creating content that is informative and actionable. I'm passionate about helping businesses achieve their marketing goals. Let's chat about how to make your product or service more user-friendly.

Get ready to digitally transform your business.

Let our team help take your business to the next level. Contact us today to get started on finding the perfect solutions for your business needs.